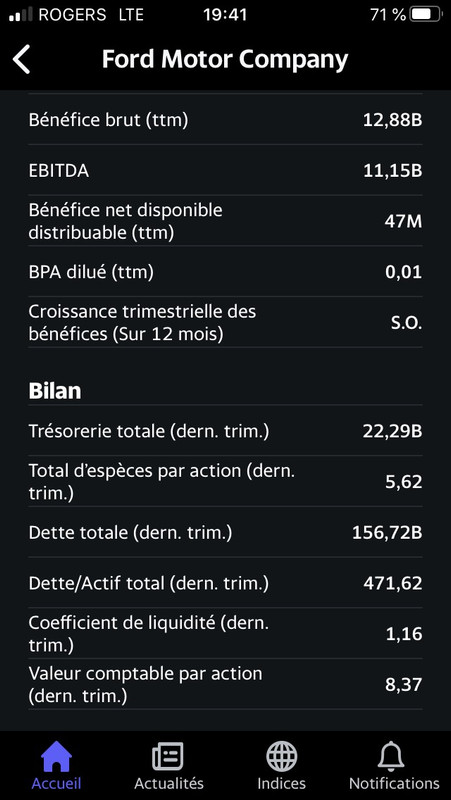

In case you're wondering, book value is a measure of a company's financial worth that is calculated by subtracting all the company's liabilities from its total assets. Generally, a stock is considered underpriced if it's trading for less than the value of its assets.

Investors currently have the rare opportunity to buy CEO Warren Buffett's masterpiece around book value -- an opportunity that has only occurred a few times. Berkshire is cheaper today than it was during the financial crisis in 2008-09 based on its price-to-book-value ratio.

Given the high returns that Buffett has earned on Berkshire's equity over the last 50 years, the market has typically placed a premium on the company's net assets. Berkshire's market value has compounded at a rate of 20% per year since Buffett took control in 1965 through 2019, although returns have slowed in recent years as Berkshire has increased in size.

Buffett has spent years assembling a collection of great businesses that meet his high standards for quality. These businesses, in aggregate, generated $254 billion in revenue in 2019 and nearly $39 billion in cash from operations. Plus, Berkshire has a fortress-like balance sheet, with over $120 billion in cash and short-term investments, which more than offsets its $65 billion in debt.

But the recent sell-off has sent Berkshire's price-to-book value ratio down to its lowest level in the last 30 years, as this chart shows.

https://www.fool.com/investing/2020/04/ ... t-now.aspx

On parle ici des légendaires actions de M. Warren Buffet, Berkshire Hathaway

BRK-A qui se transigent à ''seulement'' 290,000$USD au moment d'écrire ces lignes (!!) mais où il est expliqué l'importance du book value. Dans le cas de BRK-A, c'est environ 261,000$ de book value, c'est à dire la valeur comptable en français.

Je pense que c'est très important d'étudier le ratio entre le prix de l'action et des bénéfices (P/E ou ''price to earnings ratio) ainsi que le chiffre des ventes (revenue) et surtout la progression d'une année à l'autre, mais dans un marché qui va se faire brasser comme il va se faire brasser dans les prochains mois/années, je suis certain que les valeurs fondamentales vont (re)revenir très TRÈS importantes. Dans un monde où la liquidité est le nerf de la guerre et où l'incertitude domine, la valeur comptable sera la reine absolue.